How to Long Solana with Leverage Without Liquidation

Learn how to leverage Solana without the risk of liquidation using Haven's innovative protocol.

What is Haven?

Haven is a revolutionary leverage protocol built on Solana that offers a unique approach to leveraged trading:

- No liquidations

- No crazy volatility decay

- Low funding costs

It provides pure high-beta exposure to your favorite assets. If you believe in SOL, this is spot-holding on steroids.

How Haven Works

- Visit Haven

- Pick a token (like $SOL, $ETH, $BTC, etc)

- Choose low leverage (1.2x–2x)

- Enter your deposit and open a position

You can stay long without ever worrying about being liquidated. While shorting is also possible, we recommend starting with a long position on SOL using low leverage.

Why Traditional Holding Might Cost You Money

Let's compare different scenarios with 100 SOL at $150:

- Normal spot holding: ~$5k profit if SOL hits $200

- 2x Haven leverage: ~$10k+ profit

- Traditional leverage: $8k+ — but with massive liquidation risk

With Haven, you eliminate the risk of getting wiped out mid-cycle.

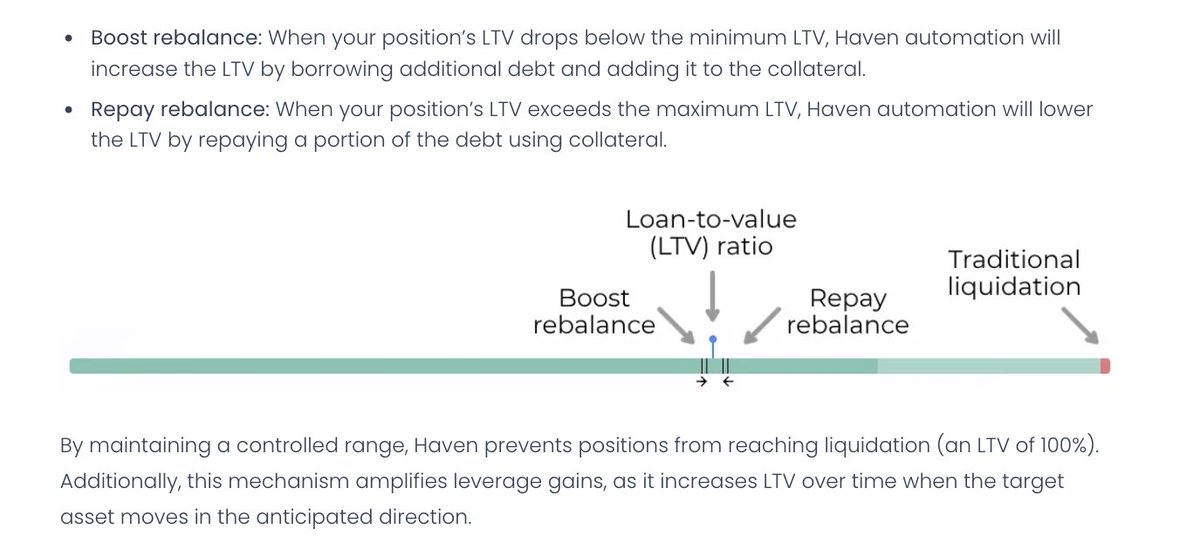

The Secret Behind No Liquidations

Haven builds on top of @marginfi but operates differently from traditional margin trading:

- Instead of borrowing against collateral like on CEX

- You deposit into a vault that auto-rebalances your exposure

- If price moves against you, it slowly de-risks your position

- No forced liquidation, no getting wiped out

- You stay alive to catch the upside

Try It Yourself

Use Haven's strategy simulator to test different scenarios:

- Pick a realistic cycle-end price

- Compare results:

- Haven outperforms spot

- Often beats traditional leverage too — especially as price increases

- Same bet for the potential price, but more profit